Canadian Investor Protection Fund

FAQs

Below you will find answers to some frequently asked questions (FAQs),

which are organized under the following headings:

General

1. How does CIPF help investors?

CIPF provides limited protection for property held by a member firm on behalf of an eligible client, if the member firm becomes insolvent. CIPF member firms are members of Canadian Investment Regulatory Organization (CIRO) that are: (i) investment dealers and/or (ii) mutual fund dealers. Please click here for a list of CIPF Investment Dealer member firms and here for a list of CIPF Mutual Fund Dealer member firms.

If you have an account with a member firm, and that firm becomes insolvent, CIPF works to ensure that any property being held for you by the firm at that time is given back to you, within certain limits. Client property that is eligible for CIPF protection includes securities and cash, but excludes crypto assets. In certain circumstances, CIPF's role may involve requesting the appointment of a trustee in bankruptcy.

CIPF protection is not available to customers for mutual fund dealer account located in Québec, unless the member firm is also registered as an investment dealer. A mutual fund dealer account is considered to be located in Québec for the purposes of CIPF coverage if the office serving the customer is located in Québec.

However, CIPF does not guarantee the value of your property. Find out more about what CIPF does and does not cover here.

2. How do I get CIPF coverage and how much does it cost?

If you have an eligible account with a member firm that is used solely for investing in securities or in futures contracts, you’re automatically eligible for coverage. And because CIPF is funded by its member firms, you do not pay a fee for CIPF protection.

CIPF protection is not available to customers for mutual fund dealer account located in Québec, unless the member firm is also registered as an investment dealer. A mutual fund dealer account is considered to be located in Québec for the purposes of CIPF coverage if the office serving the customer is located in Québec.

Please note that crypto assets held by a member firm on behalf of a client are not eligible for CIPF coverage.

3. Are non-residents of Canada protected by CIPF? What about non-Canadian citizens?

Yes, non-residents and non-citizens are eligible for coverage. CIPF protection does not depend upon the residency or citizenship of the customer.

4. I have accounts with more than one CIPF member firm. Is my protection shared over all of the member firms?

No, your protection is not shared. If you have accounts at different member firms, you have separate CIPF protection for the property being held on your behalf by each firm.

5. Is CIPF’s protection the same as CDIC’s?

No, CIPF’s protection is not the same as CDIC’s (Canada Deposit Insurance Corporation).

- If you have cash deposited in a Canadian bank, and the bank fails, CDIC coverage may apply.

- If you have cash and/or securities in your account with an investment dealer or mutual fund dealer that is a CIPF member firm, and the firm fails, CIPF coverage may apply. CIPF may also protect other property held in your account with a CIPF member firm.

- CIPF ensures that the property in your account (for example, your 100 shares in Bell Canada) is returned to you if the member firm becomes insolvent, within certain limits. However, CIPF does not guarantee the value of the property in your account. All coverage provided by CIPF is subject to the CIPF Coverage Policy, as determined by the Board of CIPF from time to time. Find out more about what CIPF does and does not cover here.

Types of Property and Losses Covered

6. Are cash balances and securities held by a member firm for a client both eligible for CIPF coverage?

Yes. If the member firm becomes insolvent, CIPF’s role is to ensure that cash balances, securities and other property the firm is holding for its clients are returned to them, within certain limits. However, crypto assets held by a member firm on behalf of a client are not eligible for CIPF coverage. CIPF also does not guarantee the value of the securities.

7. Are cash balances and securities denominated in a foreign currency eligible for CIPF coverage if they are held by a member firm for a client?

Yes. If the member firm becomes insolvent, CIPF’s role is to ensure that cash balances, securities and other property the firm is holding for its clients are returned to them, within certain limits. However, CIPF does not guarantee the value of the securities. Any claim to CIPF for missing property that is denominated in a foreign currency would be converted into Canadian funds, using the exchange rate in effect on the date of the member firm’s insolvency.

Crypto assets held by a member firm on behalf of a client are not eligible for CIPF coverage.

CIPF protection is also not available to customers for a mutual fund dealer accounts located in Québec, unless the member firm is also registered as an investment dealer. A mutual fund dealer account is considered to be located in Québec for the purposes of CIPF coverage if the office serving the customer is located in Québec.

8. Does CIPF protect the value of my GICs (guaranteed investment certificates)?

No, CIPF does not protect the value of your GICs. If you have an account with a CIPF member firm, and the CIPF member firm becomes insolvent, CIPF works to ensure that any property (including GICs) being held for you by the firm at that time is given back to you, within certain limits. CIPF does not guarantee what the GIC will be worth.

We are often asked about insurance offered by the CDIC (Canada Deposit Insurance Corporation) on these types of investments. CIPF is not related to the CDIC. For more information about the CDIC, and whether your investment qualifies for CDIC deposit insurance, contact the CDIC at 1 (800) 461-2342 or refer to their website at www.cdic.ca. Please note that CIPF member firms are not the same as CDIC member institutions.

9. I hold shares of Company X in my account with a CIPF member firm. Company X is now bankrupt. I still own these shares, but they have minimal value. Does CIPF protect me against this type of loss?

No. CIPF does not protect you from a drop in the value of investments for any reason.

10. My broker misled me into thinking the securities he recommended were safe and protected by CIPF. Now my firm (which is a CIPF member firm) and the entities that issued my investments are insolvent, and I have lost a significant amount of money. Can CIPF help me?

No, CIPF cannot help you to recover losses arising from misleading information or investments in entities that become insolvent.

CIPF’s mandate is limited to ensuring that property held in your account with a member firm at the time of insolvency is returned to you, within certain limits. If you had 100 shares in your account at the time of your broker’s insolvency, and the 100 shares were returned to you but lost some or all of their value, that loss of value is not covered by CIPF.

Other types of losses not covered by CIPF include those resulting from the following:

- fraudulent or other misrepresentations

- a lack of information

- unsuitable investments

Find out more about what CIPF does and does not cover here.

11. Are ETFs (exchange traded funds) eligible for CIPF coverage?

Yes, if the ETF securities are held by a member firm on behalf of an eligible client, the client’s ETF securities are protected by CIPF.

Investing in an ETF gives an investor “units” or “shares” in the fund. If the member firm holding your ETF units or shares becomes insolvent, CIPF’s role is to ensure that the ETF units or shares being held by the member firm for you are returned to you, within certain limits. However, CIPF does not guarantee or protect the value of your ETF investment.

Please see the glossary on this website for more information about exchange-traded funds.

12. Are mutual funds eligible for CIPF coverage?

Yes, if the mutual fund securities are held by a member firm on behalf of an eligible client, the client’s mutual fund securities are protected by CIPF.

Investing in a mutual fund gives an investor “units” or “shares” in the fund. If the member firm holding your mutual fund units or shares becomes insolvent, CIPF’s role is to ensure that the units or shares being held by the member firm for you are returned to you, within certain limits. However, CIPF does not guarantee or protect the value of your mutual fund investment.

CIPF protection is also not available to customers for mutual fund dealer account located in Québec, unless the member firm is also registered as an investment dealer. A mutual fund dealer account is considered to be located in Québec for the purposes of CIPF coverage if the office serving the customer is located in Québec.

Since investors can purchase mutual fund securities directly from the mutual fund itself, these securities may be held by the mutual fund for the investor. In this situation, where a CIPF member firm is not holding these securities on behalf of a client, CIPF coverage does not apply.

Please see the glossary on this website for more information about mutual funds.

Coverage Limits

13. I am a client of a CIPF member firm and am enrolled in the firm’s securities lending program. Which, if any, of my fully paid securities are eligible for CIPF coverage?

Your fully paid securities that are lent under the CIPF member firm’s fully paid lending program are not eligible for CIPF coverage. However, any fully paid securities not lent and held at the member firm, as at the date of insolvency of the member firm, are eligible for CIPF coverage. Find out more about what CIPF does and does not cover here.

14. What is the limit on the amount of coverage?

For an individual holding an account or accounts with a member firm, the limits on CIPF protection are generally as follows:

- $1 million for all general accounts combined (such as cash accounts, margin accounts, TFSAs and FHSAs), plus

- $1 million for all registered retirement accounts combined (such as RRSPs, RRIFs and LIFs), plus

- $1 million for all registered education savings plans (RESPs) combined where the client is the subscriber of the plan.

See What are the Coverage Limits? and the CIPF Coverage Policy for more information.

15. How do the CIPF protection limits work for property held in joint accounts?

If you have a joint account, unless otherwise evidenced in writing, your proportionate interest in the account will be presumed to be equal to that of the other person or people with an interest in the account. You would have CIPF protection for your proportionate interest in the joint account up to the limit that applies to all of your general accounts combined. The limit of coverage on all of your general accounts combined is $1 million.

16. The CIPF member firm that I have an account with told me that my account has “excess CIPF coverage”, over and above that offered by CIPF. How does that work?

Some member firms purchase private coverage to provide their clients with protection over and above protection provided by CIPF. It does not impact eligibility for CIPF coverage. Consult your account representative at your member firm for more information about any additional coverage your account may have.

17. I have two RRSP accounts at the same CIPF member firm. Each plan has a different trustee. Are these accounts combined for CIPF coverage purposes?

Yes. All of your registered retirement accounts at the same firm are combined for purposes of determining the limit of CIPF coverage. The limit of protection for property in these accounts is $1 million.

18. What are the limits of CIPF protection if I have securities worth $1.5 million in my RRSP account, my spouse has securities worth $1 million in his or her RRSP account and we have $50,000 in cash and GICs in a joint non-registered general account?

Assuming that you and your spouse qualify for coverage, and these accounts are held with a member firm that has become insolvent:

- You would have protection of up to $1 million for any securities that were missing from your RRSP account, and your spouse would have protection of up to $1 million for any securities that were missing from his or her RRSP account.

- You would each have protection for your 50% interest in the joint account up to the limit that applies to general accounts. For each of you, the limit of coverage on all of your general accounts combined is $1 million.

19. What if my account is a margin account and I owe money to the CIPF member firm. Am I still protected?

Yes, but the amount of your claim for any missing cash, securities or other property held in your account at the date of insolvency would be reduced by the amount of the cash, securities or other property you owe to the member firm.

20. Are tax-free savings accounts (TFSAs) held for a client at a member firm covered by CIPF?

Yes. A TFSA is eligible for CIPF protection. It is considered a general investment account for CIPF coverage purposes. The limit of coverage on all of your general accounts combined is $1 million.

Confirming You Have CIPF Coverage

21. What are the CIPF member firms, and how can I confirm that I am dealing with one?

CIPF member firms are members of Canadian Investment Regulatory Organization (CIRO) that are: (i) investment dealers and/or (ii) mutual fund dealers. Please click here for a list of CIPF Investment Dealer member firms and here for a list of CIPF Mutual Fund Dealer member firms.

CIPF protection is not available to customers for mutual fund dealer account located in Québec, unless the member firm is also registered as an investment dealer. A mutual fund dealer account is considered to be located in Québec for the purposes of CIPF coverage if the office serving the customer is located in Québec.

22. I believe the firm holding my account is a CIPF member, but I can’t find them under the list of current member firms on this website.

Member firms sometimes market themselves under names other than their legal entity name, which is why you may not recognize them on the list. If the legal entity name of your investment dealer or mutual fund dealer is not on your statement, please check with your account representative at the firm. If you are unable to access the list of member firms on the CIPF website, please call CIPF at (416) 866-8366 or toll free at 1 (866) 243-6981.

23. I have an account with an affiliate of a CIPF member firm. Does CIPF coverage apply to my investments in this account?

Not necessarily. Accounts with entities other than a member firm, including a member firm’s affiliates, are not covered by CIPF unless the affiliate itself is also a member of CIPF.

24. The portfolio manager that manages and provides advice on my investments is not a CIPF member, but the investment dealer holding my investments is a CIPF member. Does CIPF coverage apply if my portfolio manager becomes insolvent?

No, CIPF does not cover losses arising from the insolvency of your portfolio manager. You should contact the securities regulator in the province or territory in which your portfolio manager is located.

In your case, the investment dealer has an arrangement to provide custody and trading services to your portfolio manager and its clients. Although you are a client of both the portfolio manager and the investment dealer, CIPF coverage applies only if the investment dealer becomes insolvent, not the portfolio manager.

Insolvency

25. If my member firm is insolvent, who should I contact for information about my account?

You should contact the trustee in bankruptcy or other insolvency official who has been appointed by a court to administer the insolvent firm. A trustee in bankruptcy is a person or corporation licensed by the Office of the Superintendent of Bankruptcy Canada to administer bankruptcy proceedings. More information relating to the Office of the Superintendent of Bankruptcy Canada can be obtained on the Government of Canada website at www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/home. In most cases, the court will appoint an insolvency official to administer the affairs of an insolvent member firm.

If your member firm is insolvent and you don’t know who the insolvency official is, you may contact Canadian Investment Regulatory Organization, which is the organization that regulates investment dealers and mutual fund dealers in Canada.

CIPF protection is not available to customers for mutual fund dealer account located in Québec, unless the member firm is also registered as an investment dealer. A mutual fund dealer account is considered to be located in Québec for the purposes of CIPF coverage if the office serving the customer is located in Québec. Please contact Autorité des marchés financiers (AMF).

26. How is a trustee in bankruptcy or other insolvency official selected?

The appointment may be done at the request of the insolvent firm itself, certain creditors of the insolvent firm, or others. In certain circumstances, the appointment can be made at the request of CIPF. Depending on the circumstances of the insolvency, an insolvency official may be a trustee in bankruptcy, a receiver, a liquidator, a monitor, or other court-appointed official.

27. If a member firm is insolvent, what is CIPF’s role?

CIPF provides limited protection for property held by a member firm on behalf of an eligible client, if the member firm becomes insolvent. If you have an account with a member firm, and that firm becomes insolvent, CIPF works to ensure that any property being held for you by the firm at that time is returned to you, within certain limits. Client property that is eligible for CIPF protection includes securities and cash, but excludes crypto assets. CIPF also does not guarantee the value of your property. Find out more about what CIPF does and does not cover here.

CIPF protection is also not available to customers for mutual fund dealer account located in Québec, unless the member firm is also registered as an investment dealer. A mutual fund dealer account is considered to be located in Québec for the purposes of CIPF coverage if the office serving the customer is located in Québec.

CIPF’s role may include, in certain circumstances, requesting the appointment of a trustee in bankruptcy.

28. How is client property returned to clients if a member firm becomes insolvent?

When an insolvency of a member firm occurs, CIPF works with the trustee in bankruptcy (if one is appointed) to return any property that was being held for clients by the member firm at the date of its insolvency as quickly as possible. Since the insolvent firm can no longer carry on the function of holding property for its clients, it is generally necessary to transfer this function to another firm. As a result, client accounts may be moved to another member firm so that clients can access their accounts.

If a trustee in bankruptcy is appointed by a court, this trustee will typically be responsible for transferring client accounts to a new solvent firm. If an insolvency official other than a trustee in bankruptcy is appointed by a court, this official will often be given the responsibility of transferring client accounts to another solvent firm.

CIPF protection will apply if the property being held on a client’s behalf is not available to be returned to the client. Certain limitations apply. Please see What Does CIPF Cover? for more information on what is covered and not covered.

CIPF protection is also not available to customers for mutual fund dealer account located in Québec, unless the member firm is also registered as an investment dealer. A mutual fund dealer account is considered to be located in Québec for the purposes of CIPF coverage if the office serving the customer is located in Québec. Please contact Autorité des marchés financiers (AMF).

29. My account statement shows that the securities in my account are held in segregation. Will those securities be returned to me in the event of the insolvency of the CIPF member firm?

Not necessarily. It is possible that those securities will not be available to be returned to you if the member firm becomes insolvent. The particular circumstances of insolvencies can vary widely. For example, one of the laws that may apply to an insolvency of an investment dealer or a mutual fund dealer in Canada is Part XII of the Bankruptcy and Insolvency Act (Canada). If Part XII applies, all client cash and securities held by the insolvent firm for its clients at the time of bankruptcy, other than customer name securities (registered in the customer’s name), would be included in a single customer pool”. Any “shortfall” of client cash or securities would be allocated proportionately from the customer pool across all clients after payment of bankruptcy administration costs.

CIPF protection will apply if the property being held on a client’s behalf is not available to be returned to the client. Certain limitations apply. Please see What Does CIPF Cover? for more information on what is covered and not covered.

Making a Claim to CIPF

30. How do I make a claim to CIPF?

The information required to make a claim to CIPF is available from the CIPF website, or upon request to CIPF.

You must submit a proof of claim to CIPF within 180 days of the date of insolvency along with all documents and information to support the claim. If a trustee in bankruptcy is appointed by a court to manage the affairs of the member firm where you have an account, you may submit your claim form along with the supporting documentation to the trustee in bankruptcy, instead of CIPF. If no trustee in bankruptcy is appointed, the claim can generally be made directly to CIPF.

For more information, please refer to the CIPF Claims Procedures.

Complaints About my Broker

31. What should I do if I have a complaint about my investment dealer?

Your first course of action should be to contact your firm’s compliance department. If they cannot resolve the issue, contact Canadian Investment Regulatory Organization (CIRO), who is the national self-regulatory organization that regulates investment dealers and mutual fund dealers in Canada. CIPF is not a regulator and has no authority to investigate or regulate its member firms.

If your matter relates to an investment dealer firm, you can contact the IIROC division of CIRO at 1-877-442-4322 or [email protected]. If your matter relates to a mutual fund dealer firm, you can contact the MFDA division of CIRO at 1-888-466-6332 or [email protected]. If you are not sure, you can contact either IIROC or MFDA division and they will ensure your complaint is directed to the right place.

You may also consider contacting the Ombudsman for Banking Services and Investments (also known as OBSI) for assistance at (416) 287-2877 or 1 (888) 451-4519, or [email protected].

CIPF Disclosure Policy, effective January 1, 2023

General

32. Where can firms find a copy of the CIPF Disclosure Policy, effective January 1, 2023?

The CIPF Disclosure Policy, effective January 1, 2023 is available here.

33. What changes were made to the CIPF Disclosure Policy by the amendments made effective July 27, 2023?

Housekeeping amendments were made to address editorial and non-material typos (e.g., spacing, capitalization, consistency in terminology and to reflect the name change of the New Self-Regulatory Organization of Canada (New SRO) to the Canadian Investment Regulatory Organization (CIRO). The housekeeping amendments were approved by the Canadian Securities Administrators (CSA), in accordance with the CSA-issued orders approving CIPF as compensation fund.

34. What is the relationship between the CIRO rules and the CIPF Disclosure Policy?

CIRO’s Corporation Investment Dealer and Partially Consolidated Rule 2284 requires CIRO members to disclose to its clients, in accordance with the CIPF Disclosure Policy, membership in CIPF and the coverage available for eligible accounts.

CIRO’s Mutual Fund Dealer Rule 5.3.2(e) requires that each account statement include disclosure, as established by CIPF.

35. Does the CIPF Disclosure Policy apply to both investment dealers and mutual fund dealers?

Parts A and C apply to CIRO members registered under Canadian securities legislation in the category of “investment dealer” or in the categories of both “investment dealer” and “mutual fund dealer”.

Parts B and C apply to CIPF members registered under Canadian securities legislation in the category of “mutual fund dealer” only.

36. What does the CIPF Disclosure Policy mean when it says that “where practical, communication about CIPF coverage must be done in the same language as other communication from the CIRO member to the customer”?

This means that where it is practical to do so, a CIRO member must communicate about CIPF in the language that it usually uses in its dealings with a customer. For example, if the CIRO member usually communicates to a customer in French, communication about CIPF coverage must also be done in French.

37. Can a CIRO member, who enters into an agreement with a portfolio manager (PM) to provide custodial services to the PM and its customers, provide the PM’s contact information on its account statements?

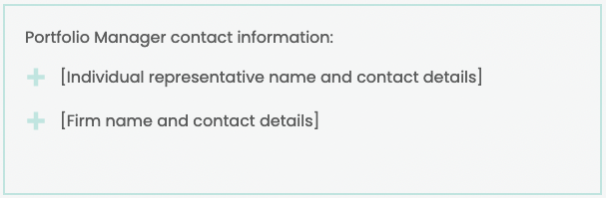

Yes, PM contact information may be included on an account statement. If a CIRO member includes PM contact information on the account statement, it must appear on the statement as follows:

However, a CIRO member must not place the PM’s contact information near the CIRO logo or CIPF Membership Identifier (such as directly above, below or beside it), or in a manner that suggests or implies that CIPF coverage applies to losses arising from the insolvency of a PM.

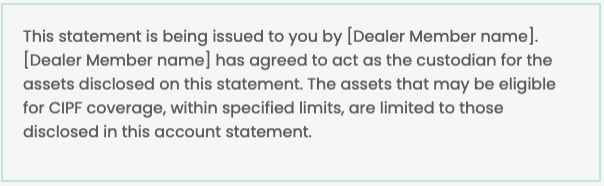

Where a CIRO member has entered into a service arrangement with a PM to provide custodial services to the PM and its customers, the following CIPF disclosure must be placed prominently on the front page of the account statement:

This disclosure on the front page is required in addition to the general requirement for CIRO members to include the CIPF Membership Identifier on the front page and the CIPF Explanatory Statement in all account statements.

CIRO members should note that CIPF coverage applies only if the CIRO member becomes insolvent, not the PM. In accordance with the CIPF Disclosure Policy, CIRO members must not make any false, misleading, or deceptive statements about the nature or scope of coverage provided by CIPF. This includes suggesting or implying that CIPF coverage applies to losses arising from the insolvency of a PM.

38. What does the CIPF Disclosure Policy mean when it says that any disclosure about CIPF created by a CIRO member for broad distribution, other than what is permitted under the CIPF Disclosure Policy, must be approved by CIPF in advance?

This means that prior approval from CIPF is required for any disclosure that:

- was not created by CIPF,

- contains disclosure about CIPF other than what is permitted under the CIPF Disclosure Policy (i.e., disclosure other than the CIPF Membership Identifier, CIPF Explanatory Statement, or the disclosure described in s. 5(b)(i) of the CIPF Disclosure Policy), and

- will be broadly distributed.

Disclosure about CIPF on electronic business sites, including websites and social media, physical business premises, and advertisements are considered by CIPF to be created by a CIRO member for broad distribution. We would be happy to work with you regarding any disclosure about CIPF that you wish to distribute broadly. Please complete and submit the CIPF Exemption and Approval Request Form available on our website here to [email protected].

39. Is a disclosure about CIPF on a website and social media considered to be disclosure “created by a CIRO member for broad distribution”?

Yes. Any disclosure about CIPF on websites and social media, other than what is permitted under the CIPF Disclosure Policy, must be approved by CIPF in advance. See also FAQ # 38.

We would be happy to work with you regarding any disclosures about CIPF that you wish to create for broad distribution. Please complete and submit to [email protected] the CIPF Exemption and Approval Request Form available here.

40. Do CIRO members have to notify CIPF if it finds out that a related or affiliated non-CIRO member is making statements about CIPF that are false, misleading or deceptive (collectively referred to as ‘false statements’)?

Yes. A CIRO member must notify CIPF if it discovers that any non-CIRO member with which it has a relationship is making any false statements about the nature or scope of coverage provided by CIPF, including disclosure about CIPF membership. This requirement is only triggered if the CIRO member becomes aware that the non-CIRO member is making false statements. A CIRO member is not required to actively review or monitor statements about CIPF made by related or affiliated non-CIRO members.

A non-CIRO member includes a financial services entity regulated by a securities regulatory authority or by another Canadian financial services regulatory regime such as banking, insurance, deposit-taking, or mortgage brokerage activities. For example, a non-CIRO member in this context could include portfolio manager (PM) that has a service arrangement with a CIRO member.

41. How do CIRO members request an exemption from a requirement(s) in the CIPF Disclosure Policy?

Please complete and submit the CIPF Exemption and Approval Request Form available here to [email protected]. CIPF will generally confirm receipt of your request within 2 to 3 business days of receiving a completed form. CIPF may request additional information or clarification from a CIRO member at any time during its review.

42. How long will it take for CIPF to review an exemption request?

CIPF aims to provide a final determination on an exemption request generally within 4 to 5 weeks of receiving a completed form, or within 4 to 5 weeks from the date on which, in CIPF’s view, complete information regarding the request has been received by CIPF.

Additional time may be required by CIPF to review requests that are more complex or that would entail a significant departure from the requirements in the CIPF Disclosure Policy. In such instances, CIPF will advise that the review will take longer and will provide an estimate regarding the timing for completion of the review.

CIPF Explanatory Statement

43. How many versions of the CIPF Explanatory Statement are available?

There are three versions of the CIPF Explanatory Statement in the CIPF Disclosure Policy:

- an Explanatory Statement for CIRO members registered as investment dealers or as both investment dealers and mutual fund dealers.

- two options of the Explanatory Statement for CIRO members registered as investment dealers or as both investment dealers and mutual fund dealers.

CIPF Membership Identifiers

44. How can CIRO members obtain a copy of the Membership Identifier (often referred to by firms as the “CIPF logo”)?

CIPF Membership Identifiers are provided upon request to [email protected].

Please specify the desired format (.eps, .jpeg or .gif) and language (English, French, bilingual) in your request. For the graphic version of the CIPF Membership Identifier, please also specify the colour variant (black, reverse white, or black and taupe).

45. What are the format, colour and size requirements for the CIPF Membership Identifier?

The CIPF Membership Identifier is available as a graphic and text version. See Appendix A of the CIPF Disclosure Policy for the prescribed formats of the graphic and text versions.

Although there are no specific size requirements for the CIPF Membership Identifier (graphic or text versions), it must be displayed so that it is clearly visible and legible, with:

- good contrast to the background to ensure maximum impact and accessibility, and

- a clear surrounding area without graphic elements or text.

The graphic version of the CIPF Membership Identifier:

- must be produced from a digital master reference available from CIPF by emailing your request to [email protected], and

- must not have its design altered in any way, but may be altered with respect to its overall size, provided that the relative proportions and colours are maintained and the content is clearly visible and legible.

- The graphic version is available in three colour variants (black, reverse white, or black and taupe).

The text version of the CIPF Membership Identifier does not have any font, minimum point size or colour requirements.

CIPF Official Brochures

46. How can CIRO members order an electronic CIPF Official Brochure?

Electronic versions of the CIPF Official Brochures are available exclusively for CIRO members and must be purchased directly from CIPF’s designated printer using the order form located here. The printer will provide the PDF to the CIRO member for distribution.

47. What are options are available for the CIPF Official Brochure?

CIPF brochures are available in English or French and CIRO members have the option of ordering blank or imprinted hard copy brochures, or an electronic brochure. The electronic brochure is also available in an accessible format, which complies with Accessibility for Ontarians with Disabilities Act (AODA).

48. Can a CIRO member’s trade name or division name be imprinted, stamped or printed on the CIPF Official Brochure?

No. Only the legal name of the CIRO-regulated firm can be imprinted, stamped or printed on the CIPF Official Brochure.

49. Are trade names or divisions of CIRO members required to distribute the CIPF Official Brochure?

Trade names or divisions of CIRO members are not obligated to distribute the CIPF Official Brochure to customers under the CIPF Disclosure Policy. If the CIRO member’s trade name or division distributes a CIPF Official Brochure, that brochure must be imprinted, stamped or printed with the name of the legal entity that is the CIRO member.

50. Is a print-out of the PDF version of the CIPF Official Brochure considered to be an official version?

Yes. A print-out of the PDF version purchased from CIPF's printer of the CIPF Official Brochure can be provided to customers and is considered to be an official version of the CIPF Official Brochure. Please note that you must not change any aspect of the PDF received from CIPF’s designated printer.

51. Can a CIRO member provide customers with an electronic or hard copy of the CIPF Official Brochure as part of a customer application package?

Yes. The CIPF Official Brochure may be included in a customer application package only if:

- You do not change any aspect of the CIPF Official Brochure

- The pages of the CIPF Official Brochure are not presented on the same page as other content in the customer application package (for example, in a double-sided package, the CIPF Official Brochure cannot be imprinted on the back of a document that is not the CIPF Official Brochure), and

- The CIPF Official Brochure is imprinted, stamped or printed with the legal name of CIRO-regulated firm.

Websites

52. Can a website in the name of a CIRO member’s trade name display the CIPF Membership Identifier?

Yes. The CIPF Membership Identifier is permitted on a CIRO member’s trade name’s website provided that:

- it is not a separate legal entity from the CIRO member,

- the full legal name of the CIRO member is also clearly visible, and

- the use of the CIPF Membership Identifier is in compliance with the General Principles of the CIPF Disclosure Policy.

53. If the CIRO member’s website is part of a combined financial institution group website, can the CIPF Membership Identifier be displayed throughout the website?

If a CIRO member’s website is part of a combined financial institution group website or if a CIRO member employs dually employed representatives, the CIPF Membership Identifier is to be displayed only on the webpages within the website that relate to activities for which CIPF coverage is available.

However, there is one exception to this rule. The CIPF Membership Identifier can be displayed as part of a banner that is included across multiple or all webpages within the combined financial group website, provided that those webpages that relate to activities for which CIPF coverage is not available include clear and visible disclosure indicating that CIPF coverage does not apply. CIRO members do not need to provide this disclosure to CIPF for approval.

Transitioning Membership Disclosure

54. What should CIRO members know about changes to the CIPF’s membership disclosure?

The main things to know are:

- Effective January 1, 2023, CIPF’s name in French was changed to “Fonds canadien de protection des investisseurs” and “FCPI” as the acronym. Accordingly, any references to the Former CIPF’s French name “Fonds canadien de protection des épargnants” or “FCPE” will need to be replaced.

- Effective January 1, 2023, CIPF has a new logo to reflect the amalgamation of the Former CIPF and MFDA IPC. The new logo has been incorporated into CIPF’s Decals and Membership Identifiers. Accordingly, these disclosure materials will need to be replaced.

- CIPF’s Explanatory Statements have changed to refer to CIPF’s two segregated funds (the Investment Dealer Fund and the Mutual Fund Dealers Fund). Accordingly, Explanatory Statements will need to be updated with the applicable Explanatory Statement.

- CIPF’s Official Brochures have been updated to reflect the amalgamation of the Former CIPF and MFDA IPC.

- CIRO members must update any Former CIPF membership disclosures by December 31, 2024. For clarity, CIRO members may update their membership disclosure anytime prior to December 31, 2024.

55. When are CIRO members required to comply with the CIPF Disclosure Policy, effective January 1, 2023?

A two-year transition period was set for the changes required by the CIPF Disclosure Policy. Firms that were members of the Former CIPF and MFDA IPC prior to January 1, 2023 must be in compliance by January 1, 2025. Until then, each CIRO member can continue to comply with the disclosure requirements that were applicable to the CIRO member immediately prior to January 1, 2023 namely, the Former CIPF Disclosure Policy, effective February 10, 2021, or MFDA Rule 5.3.2(e) and MSN-0083. All references in a CIRO member’s disclosure, website and documentation to a predecessor of CIPF will be deemed to be a reference to CIPF.

For clarity, CIRO members may comply with the requirements under the CIPF Disclosure Policy effective January 1, 2023 anytime prior to December 31, 2024.

The Former CIPF Disclosure Policy can be found here. Information regarding MFDA Rule 5.3.2(e) and MSN-0083 can be found here.

Firms granted CIRO membership on or after January 1, 2023, are required to comply with the CIPF Disclosure Policy, on the earlier of: (a) the date the membership is granted, or (b) June 30, 2023.

56. If a CIRO member still has inventory of the Former CIPF Brochures, can they be provided to customers?

Yes. The Former CIPF Official Brochure (version dated December 2016) can be provided to customers until December 31, 2024.

57. What Former CIPF disclosure materials are CIRO members required to change with respect to CIPF’s French name and rebranding?

Members of Former CIPF will need to update the following disclosure materials:

- CIPF Decal;

- CIPF Official Brochure;

- Any graphic versions of the CIPF Membership Identifier on the CIRO member’s website, account statements, and confirmations

- French and bilingual text versions of the CIPF Membership Identifier on the CIRO member’s website, account statements and confirmations;

- replace the Former CIPF Explanatory Statement with the CIPF Explanatory Statement on account statements and confirmations;

- for CIRO members that have a service arrangement with a registered portfolio manager to provide custodial services to the portfolio manager and its customers: ensure the additional disclosure required on account statements under section 9(b) of the CIPF Disclosure Policy, effective January 1, 2023 has been updated with the CIPF French name; and

- any other relevant disclosures mentioning the Former CIPF.

58. What Former MFDA IPC disclosure materials need to be updated?

Former MFDA members must update the Former MFDA IPC disclosure on account statements with the CIPF Explanatory Statement set out in Part B, Section 10 of the CIPF Disclosure Policy.

This disclosure must be updated by December 31, 2024. For clarity, CIRO members may update their membership disclosure anytime prior to December 31, 2024.

59. What new key requirements does the CIPF Disclosure Policy, effective January 1, 2023 place on Former MFDA members?

After the completion of the two-year transition period ending December 31, 2024, CIRO members registered as mutual fund dealers must:

- be informed by the General Principles, as set out in Section 2 of the CIPF Disclosure Policy, in their reasonable efforts to comply with Parts B and C of the CIPF Disclosure Policy;

- get prior CIPF approval for any disclosures about CIPF created by a CIRO member for broad distribution. This means that prior approval from CIPF is required for any disclosure that:

- was not created by CIPF,

- contains disclosure about CIPF other than what is permitted under the CIPF Disclosure Policy (i.e. disclosure other than the CIPF Membership Identifier, CIPF Explanatory Statement, or the disclosure described in s. 5(b)(i) of the CIPF Disclosure Policy), and

- will be broadly distributed.

Notify CIPF if it discovers that any non-CIRO member with which it has a relationship is making any false, misleading or deceptive statements about the nature or scope of coverage, or the limitations and exclusions from coverage, provided by CIPF, including CIPF membership.

60. What should CIRO members operating in Québec know about Bill 96 and how it affects the use of CIPF’s Decals and Membership Identifiers?

Bill 96, which became law on June 1, 2022, introduced changes to Quebec’s Charter of the French Language regarding the use of non-French trademarks on signs and commercial advertising (including websites). CIPF’s Decals and Membership Identifiers incorporate CIPF’s trademark.

CIRO members in Québec are advised to confirm that use of their selected CIPF Membership Identifier and CIPF Decal are in compliance with the legislation in Québec regarding trademarks on public signs and posters and commercial advertising. The English ‘CIPF’ and French ‘FCPI’ logos, effective January 1, 2023, are expected to be officially registered with the Canadian Intellectual Property Office in and around March 2026.

CIPF Membership Identifiers and CIPF Decals are available exclusively in French.